Tanpa Curry, Warriors Jadi Bulan-bulanan Timberwolves

Pendahuluan Tanpa Curry, Warriors Jadi Bulan-bulanan Timberwolves. Dalam dunia basket NBA, kehadiran Stephen Curry selalu…

Warriors Bertahan Tanpa Stephen Curry Selama Satu Minggu

Pendahuluan Dalam dunia basket profesional, kehilangan pemain kunci bisa menjadi ujian besar bagi sebuah tim.…

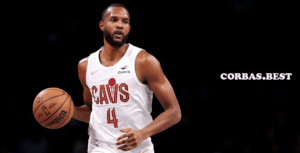

Tyrese Haliburton Bikin Cavs Gigit Jari di Gim 2

Pendahuluan Pertandingan playoff NBA seringkali menjadi panggung bagi para bintang untuk bersinar, dan di Game…

Kristaps Porzingis Sakit, Diragukan Tampil di Gim 2

Pendahuluan Perjalanan Boston Celtics menuju Final NBA 2024 telah ditandai oleh dominasi dan performa tim…

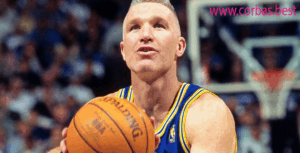

Buddy Hield Membara! Warriors Sempurna di Gim 7 lawan Rockets!

Pendahuluan Buddy Hield Membara!Ada malam-malam di NBA yang terasa seperti cerita epik yang ditulis di…

Nuggets Permalukan Clippers di Gim 7: Comeback Epik dan Keruntuhan LA

Pendahuluan Denver Nuggets menuliskan babak epik dalam sejarah NBA Playoffs dengan mempermalukan Los Angeles Clippers…

Diana Taurasi “La Pista”, Sang Legenda Phoenix Mercury, dan Perdebatan Pemain

Pendahuluan Diana Taurasi "La Pista" Dalam jagat bola basket wanita profesional, ada beberapa nama yang…

David Ademan Kesal Karena Nikola Jokic Hanya Dapat Dua Tembakan Gratis

Pendahuluan Asisten pelatih Denver Nuggets, David Adelman, tak mampu menyembunyikan kekesalannya terhadap kinerja wasit dalam…

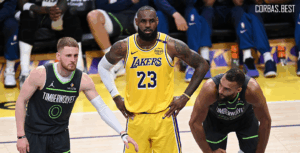

LeBron James Sindir Lakers Soal Kekurangan Center

Pendahuluan Setelah Los Angeles Lakers tersingkir dari babak playoff NBA 2025 usai kalah dari Minnesota…

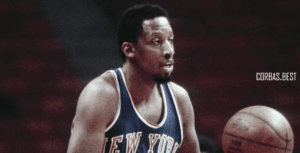

Monster di Lapangan Basket: Sebutan untuk Shaquille O’Neal

Pendahuluan Monster di Lapangan Basket Dalam dunia bola basket, nama Shaquille O’Neal identik dengan kekuatan…